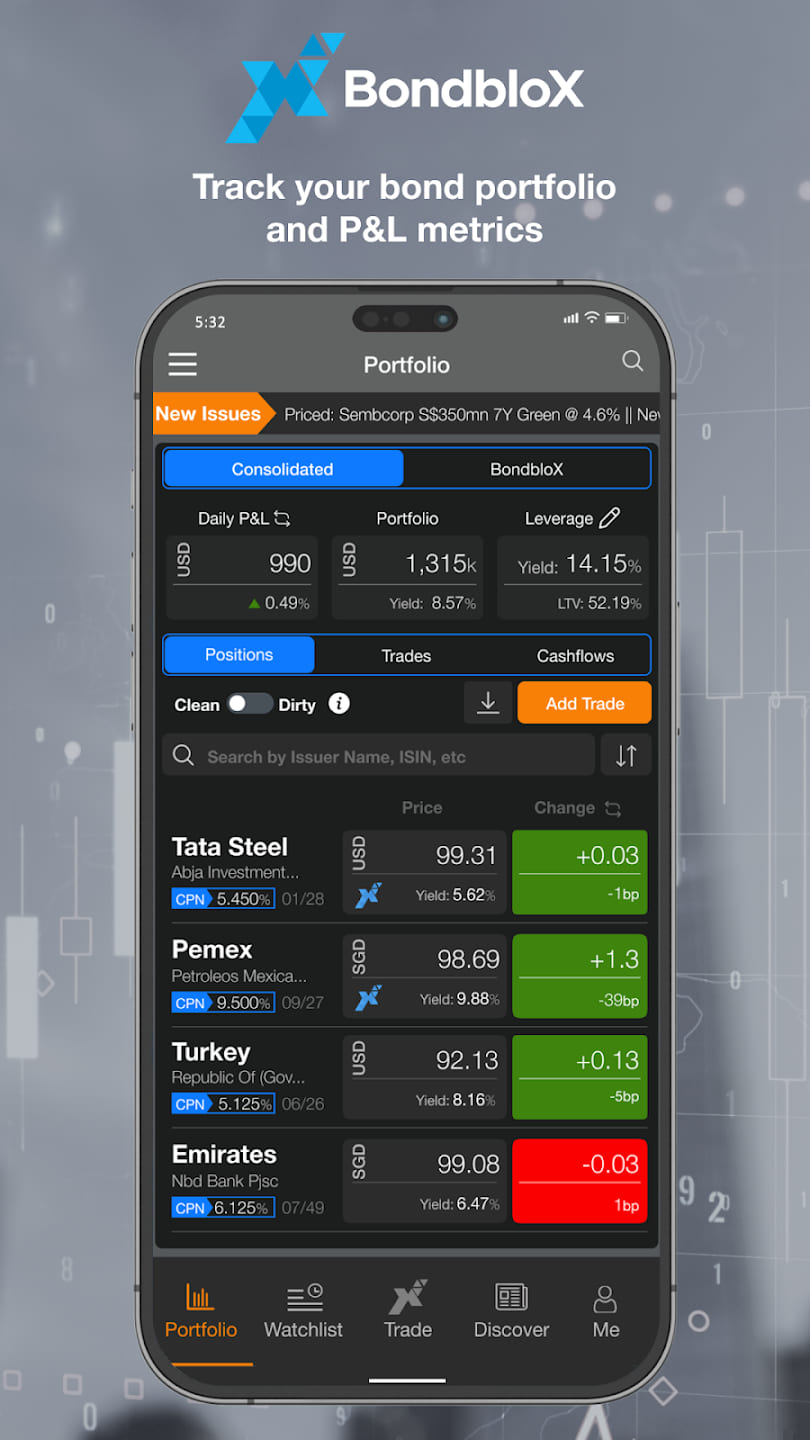

About the application

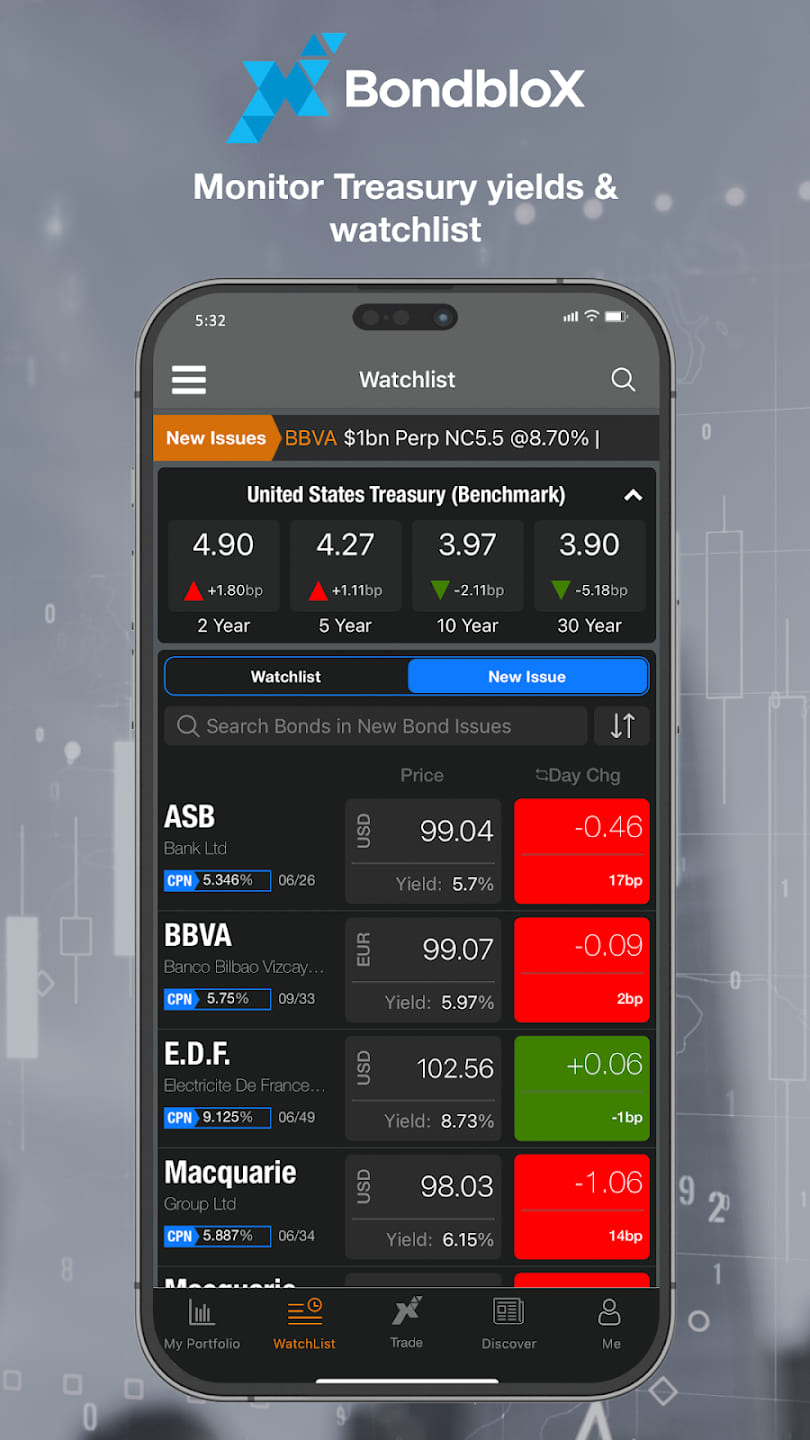

BondbloX is your gateway to seamless stock investing directly from your mobile device. Our app revolutionizes the way you invest, offering a user-friendly platform with low fees and a vast array of investment opportunities. Whether you're a seasoned investor or just dipping your toes into the world of finance, BondbloX provides the tools and resources you need to grow your wealth effortlessly.

With BondbloX, you can access a diverse selection of stocks across various industries, allowing you to build a well-rounded investment portfolio tailored to your financial goals. Our commitment to security ensures that your investments are protected, giving you peace of mind as you navigate the markets. Experience the future of investing with BondbloX – download the app now and take control of your financial future.

Important

The purpose of this document is to offer comprehensive insights into different investment strategies aimed at fostering a broad understanding in this domain. The recounted experiences herein provide an overview of diverse investment methodologies and are not intended as specific recommendations. It's crucial to acknowledge that investing inherently carries risks; thus, prospective investors are strongly encouraged to familiarize themselves with the fundamentals before reaching a final decision. Each investor should independently evaluate risks and assume full accountability for their investment choices. The company bears no responsibility for any inaccuracies or losses stemming from the utilization of the provided information, nor does it assure the absence of direct or indirect losses associated with the material's utilization.

Artificial Intelligence in BondbloX:

Incorporating Artificial Intelligence (AI) into BondbloX revolutionizes the investment experience, empowering users with sophisticated tools to make informed decisions. Through AI algorithms, BondbloX analyzes vast datasets and market trends in real-time, providing personalized investment insights tailored to each user's preferences and risk appetite.

With AI in BondbloX, users can access advanced predictive analytics, enabling them to anticipate market movements and identify lucrative investment opportunities with greater precision. Whether it's optimizing portfolio allocations or suggesting potential investment strategies, AI-driven features enhance the efficiency and effectiveness of investment decision-making, ultimately maximizing returns and minimizing risks for users.

Personalized Investment Recommendations: With AI integration, BondbloX provides personalized investment recommendations tailored to each user's financial goals, risk tolerance, and investment preferences, ensuring a customized investment approach.

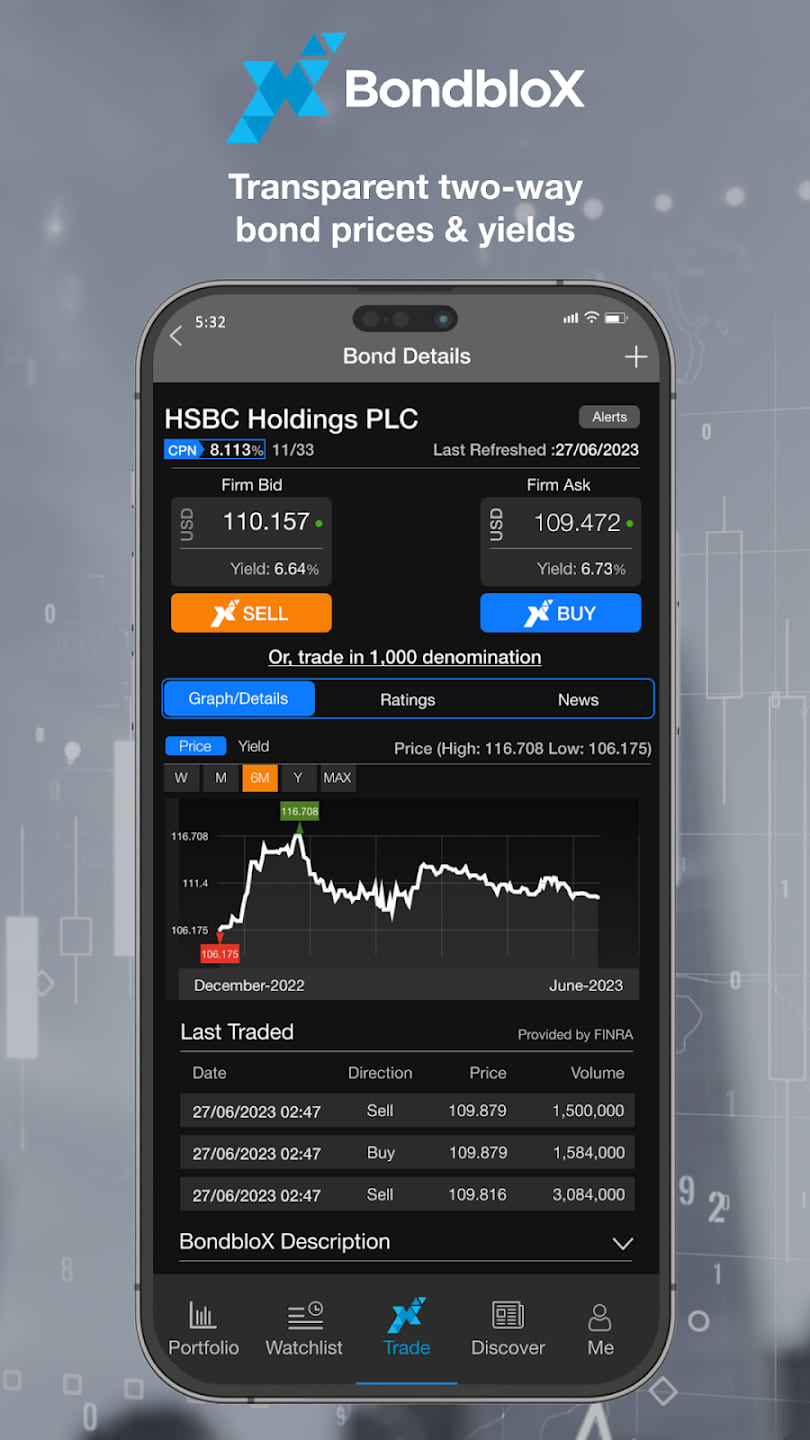

Real-Time Market Insights: Leveraging AI algorithms, BondbloX offers real-time market insights and trend analysis, empowering users to stay ahead of market movements and make timely investment decisions with confidence.

Risk Management Solutions: AI-powered risk management tools in BondbloX assist users in identifying and mitigating potential investment risks, enhancing overall portfolio resilience and safeguarding against unforeseen market fluctuations.

Innovative Approaches to Financial Management in BondbloX

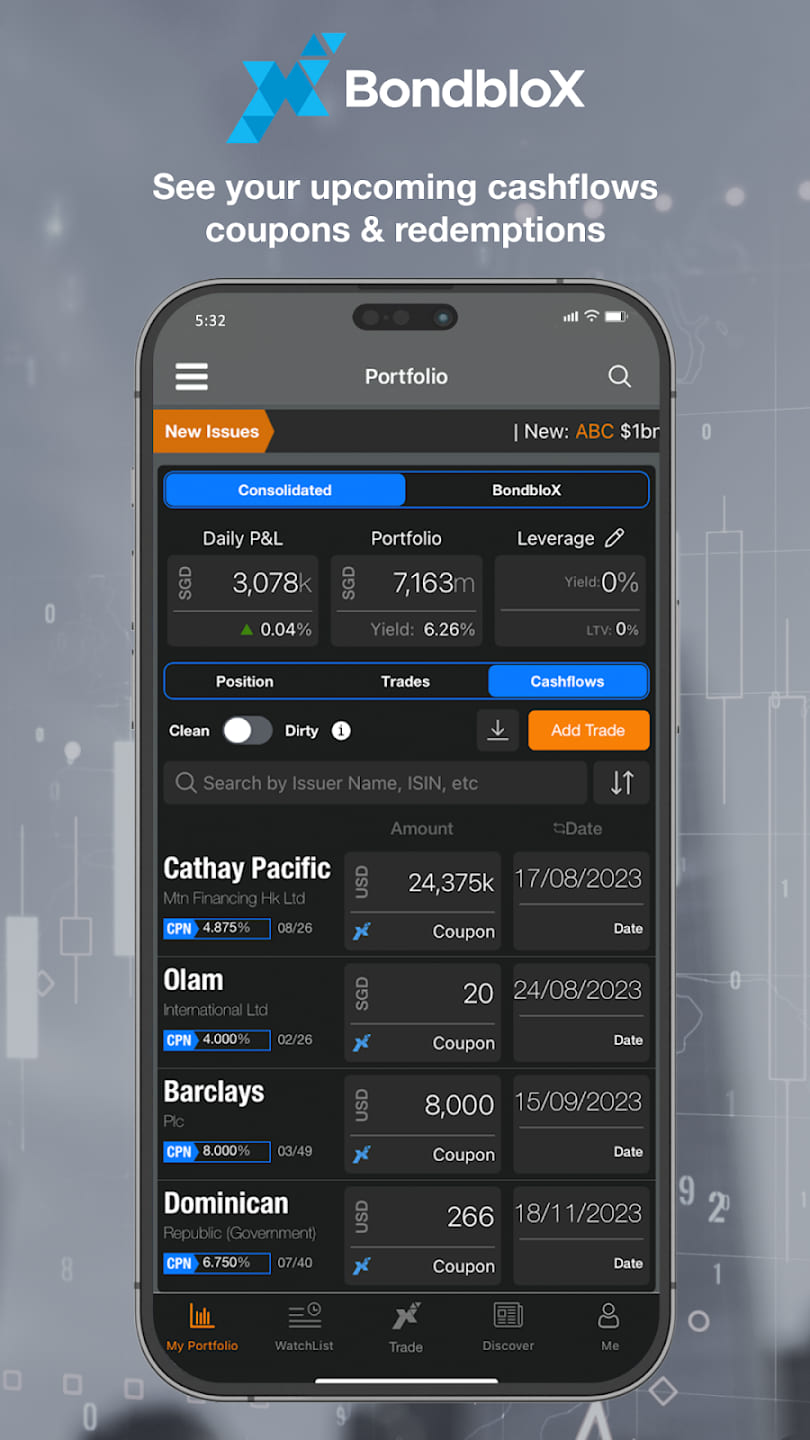

In BondbloX, innovative approaches to financial management redefine how users interact with their investments, offering cutting-edge tools and features to optimize portfolio performance. From AI-driven investment strategies to intuitive risk assessment tools, BondbloX empowers users to take control of their finances like never before, driving toward greater financial prosperity.

Individual Plans to Achieve Financial Goals

Individualized plans tailored to each user's financial aspirations pave the way for achieving specific goals within BondbloX, ensuring personalized strategies aligned with users' unique circumstances and ambitions.

Reviews from our clients

"BondbloX has transformed my approach to investing - its AI-driven insights have helped me make smarter decisions, and the low fees make it a top choice for growing my portfolio."

Michael, 37 years old

2

"As a beginner investor, BondbloX has been a game-changer for me - the educational resources and personalized recommendations have given me the confidence to start investing, and I'm already seeing positive results!"

Sarah, 30 years old

3

"I've been using BondbloX for years now, and I couldn't be happier - its user-friendly interface, real-time market insights, and reliable security features make it my go-to app for all my investment needs."

John, 32 years old